About Us

A coordinated determination to make our India a financially inclusive and self-sufficient is the driving force behind all our initiatives. We are determined to provide easy access to financial services to everyone, everywhere and possibly every day. In this course of journey, we are the multiple vertical experts joined hand in hand and committed members, who forged the actions. We are determined to ensure our supervisor and our members grow and prosper in this digital age and together we contribute to a stronger India.

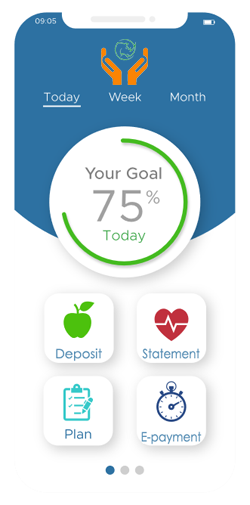

Digital and easy banking at your doorstep - Financial Inclusion Redefined

Despite India boasting economic growth rates higher than most developed countries in recent years, a majority of the country’s population still remains unbanked. Financial Inclusion is a relatively new socio-economic concept in India that aims to change this dynamic by providing financial services at affordable costs to the underprivileged, who might not otherwise be aware of or able to afford these services. Global trends have shown that in order to achieve inclusive development and growth, the expansion of financial services to all sections of society is of utmost importance. As a whole, financial inclusion in the rural as well as financially backward pockets of cities is a win-win opportunity for everybody involved – the banks/NBFC’s intermediaries, and the left-out urban population. Banks will handle core infrastructure and services while intermediaries known as Business Correspondents (BC’s) will be the executors and act as the face of these banking & financial institutions in dealing with end-users. The Business Correspondents (BC’s) shall be carrying handheld terminals like Tablets (GSM enabled) coupled with portable biometric scanner, smart card swipe machines as well as thermal Bluetooth printers for carrying out their online banking activities on the field.

Sama Artha – nearby banking system to solve your financial needs

Our Vision

Simplifying the digital banking

Our Mission

provide affordable, convenient financial solution to all citizen at ease

Promote Your Business with Sama-Artha

We are pioneer in providing the ultimate Digital Payment solution focusing on reaching Millions Of Customers To Serve Better in E-Payments Solutions, E-Commerce, Financial Products Sales & Services, and many others under one roof.

Financial inclusion...a brief note

Finance is very essential for every economic activity. Without adequate finance no activity can be undertaken. Finance is also required by the every section of the society. But from the beginning of the civilization, only the financial needs of the upper section of the society were catered. Access to finance by the poor and weaker groups is very difficult. This is due to the various reasons such as lack of banking facilities for this section, unawareness about the schemes available for them, lack of a regular or substantial income etc. Financial inclusion denotes delivery of financial services at an affordable cost to the vast sections of the disadvantaged and low-income groups. The various financial services include credit, savings, insurance and payments and remittance facilities. The objective of financial inclusion is to extend the scope of activities of the organized financial system to include within its ambit people with low incomes. Through graduated credit, the attempt must be to lift the poor from one level to another so that they come out of poverty. Financial inclusion mainly focuses on the poor who do not have formal financial institutional support and getting them out of the clutches of local money lenders

We are having Partnership with

Our Clientele

HSA Construction

HSA Engineering and Construction Private Limited is a registered company under the Ministry of Corporate Affairs, Government of India.

AETSE

provide affordable, convenient technical solution to all citizen at ease